SIMPLY SOLD CASH HOME BUYER REAL ESTATE CONTRACT

Think back to the last time you sat down with your agent to go over selling your house or when you received an offer on your property… Do you remember the contract being self explanatory or were you reading 15 pages of language that only realtors and attorneys understand? We’re here to Simplify the process and provide a quick and easy agreement that has 3 pages and requires one signature.

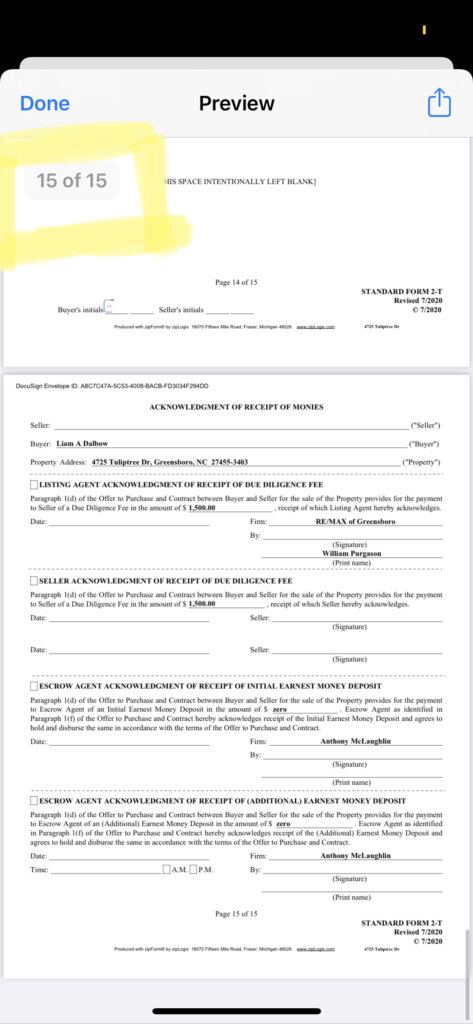

Realtors Standard Offer to Purchase Agreement – 15 Pages 10+ Signature / Initial & Property Disclosure

Simply Sold Property Agreement – 3 Pages & 1 Signature

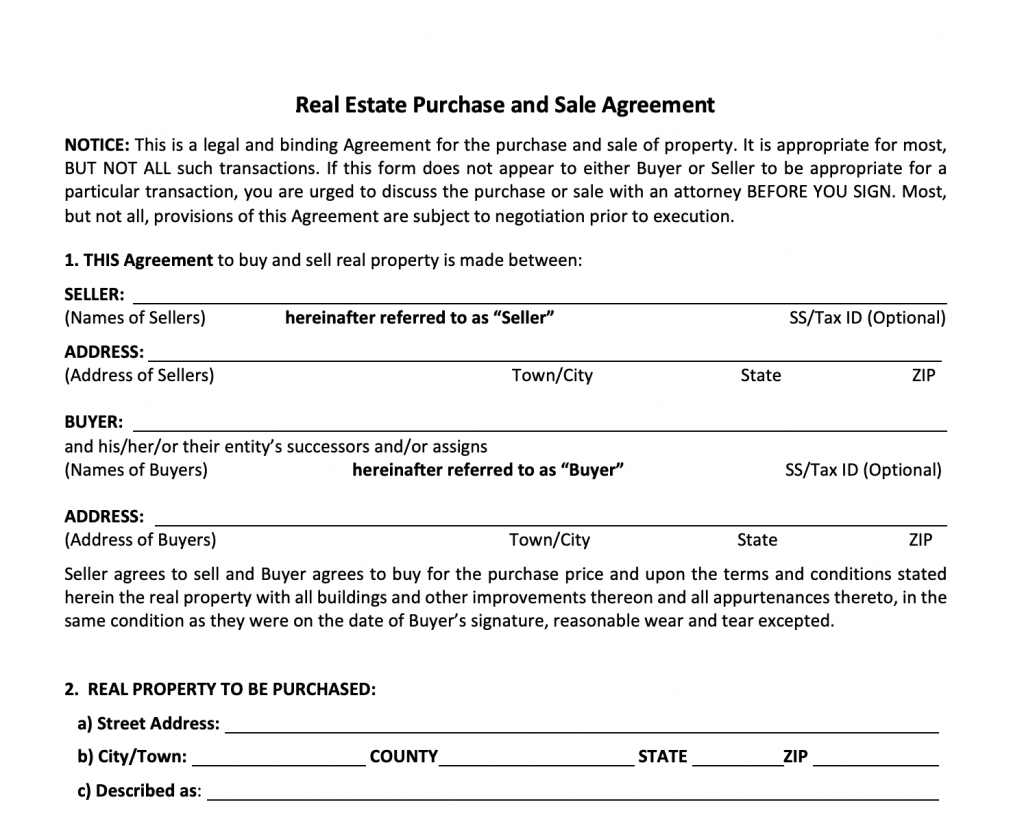

The Simply Sold Purchase Agreement Page 1 – This section above is the basics – Who the seller is, who they buyer is and where they reside in case the attorney has to send any documents through the mail which is quite frequent during selling your house during COVID-19. Section 2 goes over the real property to be purchased.

So far so good?

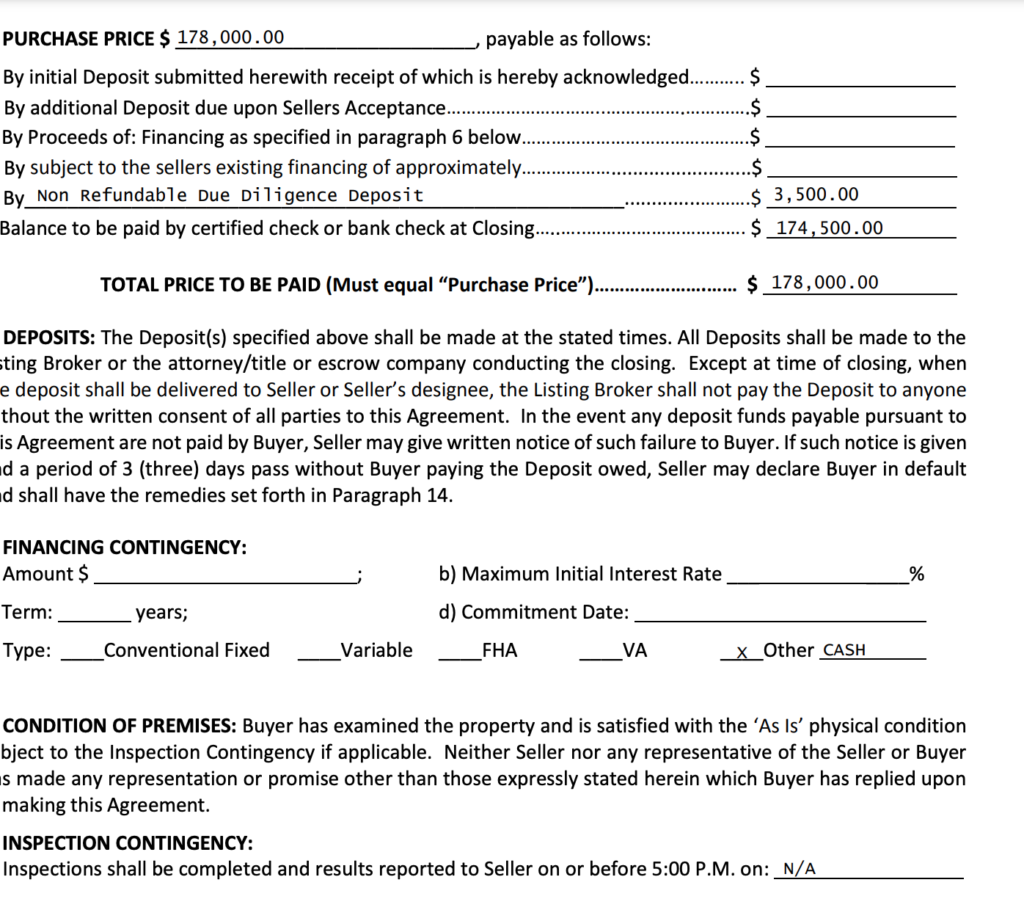

Page 2 is an important page that goes over how the property is going to be financed as well as the inspection contingency which is crucial for the earnest money and due diligence. Due diligence is non refundable money that gives you a time period to inspect, appraise and review the property. If the buyer backs out during the due diligence period the due diligence deposit is forfeited.

Earnest money is the money that is deposited in good faith that you are going to close on the property and is held with the attorney or agent in a trust account. This money can be refunded if the buyer terminates the agreement during the due diligence period.

Simply Sold Property does NO due diligence period, inspections or appraisals and gives non refundable money at the time of accepted offer so you get money at the time of signing and can feel more comfortable that the buyer is not going to walk away.

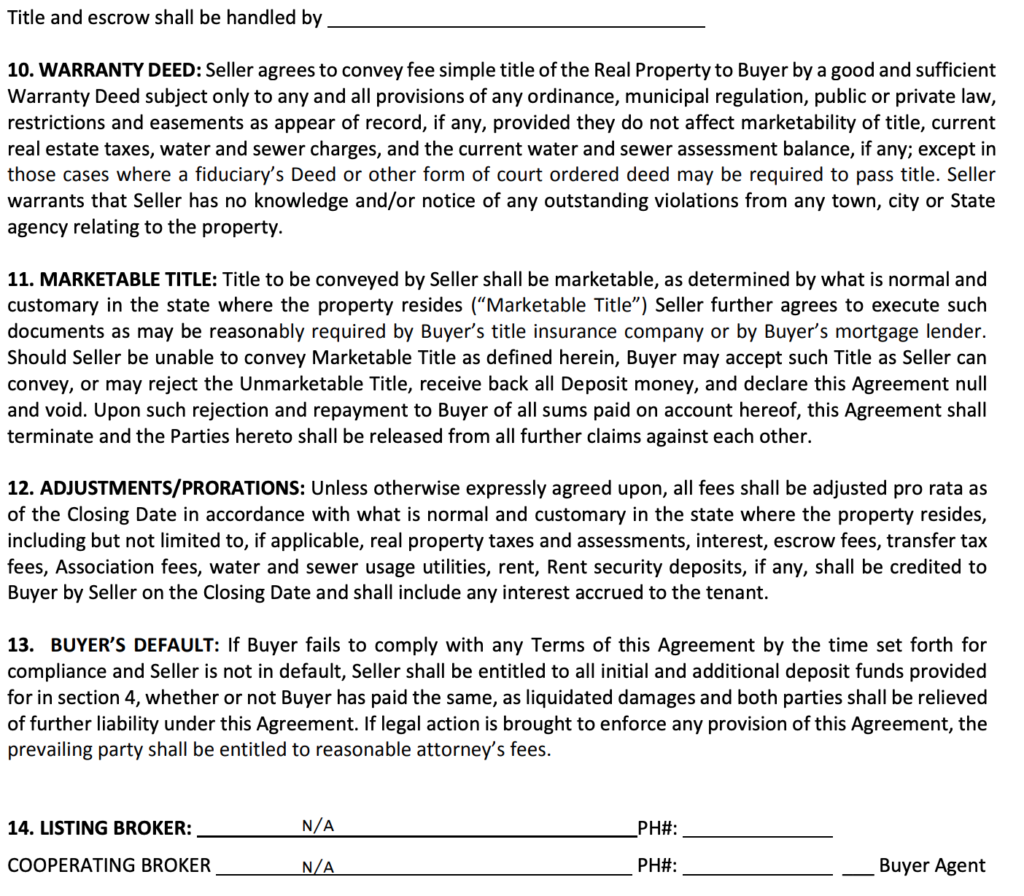

Page 3 reviews that the seller is able to convey clear title for the property and that there are not any outstanding judgements that we did not discuss. Marketable title is a title that a court of equity considers to be so free from defect and that it will legally force its acceptance by a buyer. If the title has defects that the buyer was not aware of the buyer can have the option to ask the seller to clear the title or to terminate if not.

Adjustments and prorations are credits between the buyer and seller at closing that ensure each party is only paying these costs for the time that they owned the home. They will show up as debits or credits on each party’s closing statement and apply to taxes or any current leases. For example if the annual taxes are $5,000 and we buy the property in June, the taxes will be prorated in half where we pay our half when owning the property.

If the buyer defaults in any way the seller is obligated to any additional deposits and any liquidated damages during the time. If a buyer backs out and the tenant leaves, you are obligated to the liquidated damages of the missing rent.

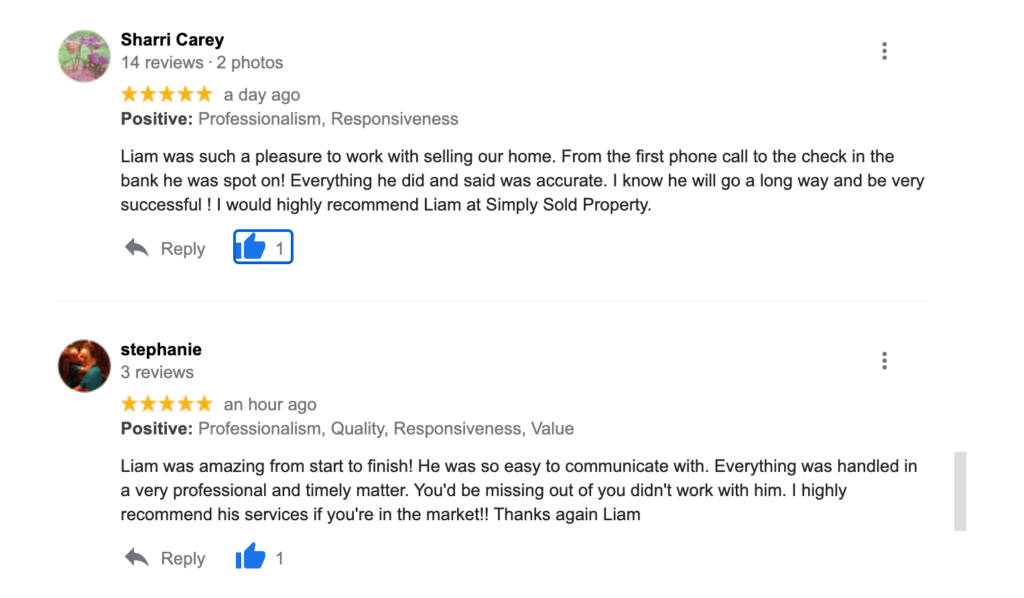

NC Cash Buyer Reviews

Some Key Terms About Greensboro Real Estate Contracts

Contract Assignments

While it may sound complicated, Greensboro real estate contracts are often assigned to another buyer. This means that the cash buyer who made you a low ball offer is looking to resell this contract to an end buyer like Simply Sold! We get these calls all the time and is how we find some of our best deals. But we can pay more and cut out that middle man and put more cash in your pockets plus cut out an extra step.

“Subject To”

Selling property as “subject to” means an existing loan is being taken over subject to its current terms including interest rate and amortization period. This can be desirable for investors because they are able to capitalize on a lower interest rate (if applicable) or to be further along in the amortization as most of the first 12 months payments are all interest anyways. This is yet another way that Greensboro contracts may be written.

This clause in a real estate contract allows a distressed seller, who may otherwise lose the property, to assign payments and right of residency to the buyer. Ownership of the property remains with the seller, who is still responsible for the original mortgage with the lender. The buyer is under no obligation to the lender, so should the worst happen and they fail to make the payments, regrettably, it is possible for the property to end up in foreclosure.

Purchase Agreements

A purchase agreement is what may be considered the most common style of Greensboro real estate contracts. This is a fairly simple and straightforward sale between the seller and buyer and contains all the elements of a legally binding contract. The documents we go over in the video and pictures attached were our Purchase Agreement we use when buying houses for cash in North Carolina. If you are working with an agent, it will likely be a state, Realtors, or association contract. If the sale is directly between the seller and the buyer, then a standard purchase agreement is typically used that is written by an attorney. (Best practice in case of lawsuit) As for properties other than single-family, you may need to make use of a property-specific form.

Lease Agreements

If your plans involve becoming a landlord, your Greensboro real estate contracts will involve lease agreements. This guarantees the tenant the use of the property, for a specified period, while at the same time providing you with a guaranteed monthly income. These contracts are carefully laid out to avoid any confusion or misunderstanding of any issues that may arise and what exactly is expected from each party involved. You’ll want to be certain that you’re meeting all local, state, and federal guidelines.

Power of Attorney

While not commonly thought of, the power of attorney can be extremely useful in real estate contracts. Through the use of the power of attorney, you can convey your rights to conduct business to someone who is entrusted with your finances, an attorney, or an agent. They come into play when the owner is either not available to conduct business or is incapacitated, has had an accident, or is in seriously declining health and unable to conduct business any longer.

Rent to Own

The rent to own strategy is advantageous real estate contracts for Greensboro investors. As the seller, you collect monthly rent along with additional monies. The buyer has the ability to try the house out for a specified time period. There are two types of these contracts, the option to buy or the agreement to buy. The agreement to buy tends to be much more desirable to sellers, in general, given that the home must be purchased at the end of the agreement period by the renter. This strategy allows buyers time to build savings towards a deposit on a conventional loan and find financing. Should your buyers have chosen the option contract, they are not obligated as in the agreement to buy. Should they be unable to qualify for a mortgage loan the renter can simply walk away at the end of the agreement.

Do not let intimidating contracts stop you from success in your investment business. The professionals at Simply Sold Property are the best guide you could have to walk you through real estate contracts, we make your Greensboro real estate investment business easy. At Simply Sold Property, we take the time to listen to your dreams and help you make plans, and update plans as your life and goals change over time. When a great deal can be yours, you will know you’re using the contract that best suits your long term investment goals. Why not get started now? Just send us a message or call Simply Sold Property at (336) 530-5204 today!